Let me start by saying Shane and I have never purchased health insurance from the major providers here in the south (Bluecross Blueshield or United), nor have we ever been able to afford it! Neither of us in the last 9 years of marriage have been able to score a job that provided healthcare either. However, we have had health coverage from an alternative place for the last 6 years and it's only cost us $90 a month combined.

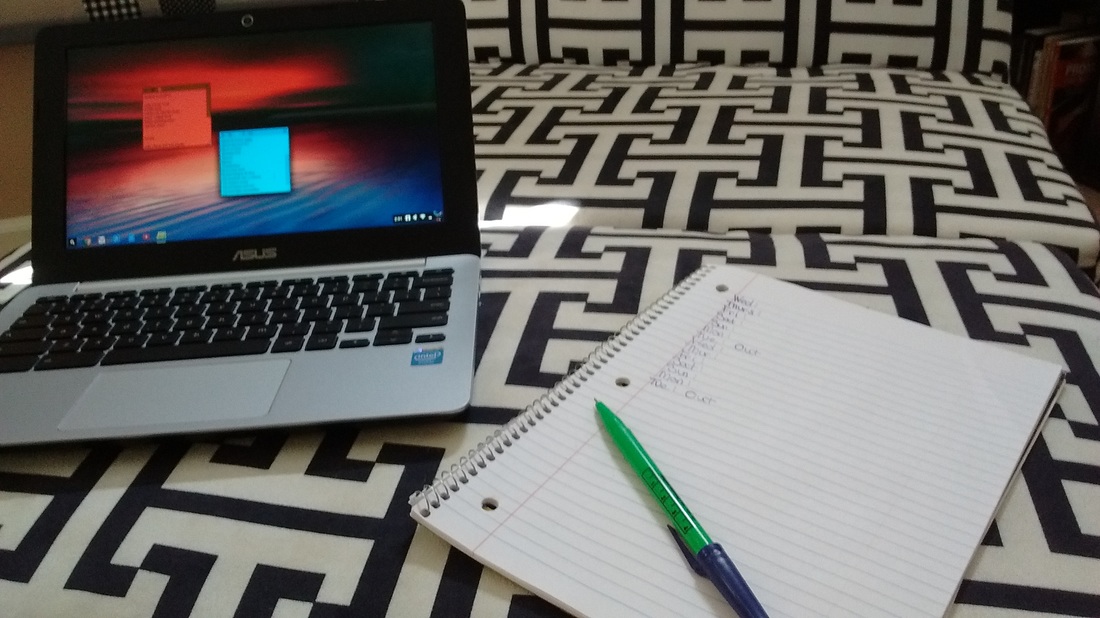

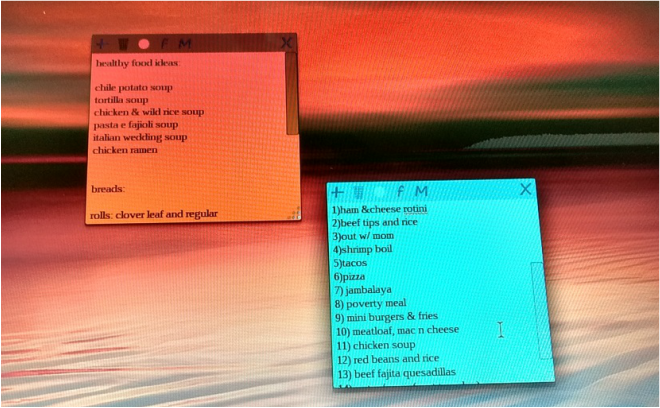

Here's an estimate of what we would be paying monthly for typical heath insurance under the Affordable Care Act...

I did a little research, and based on our family income, we would be paying about $300 a month per person for heath insurance under the Affordable Care Act. For that cost, I think we'd be better off paying for all medical expenses in cash... especially when you consider that most doctors and hospitals charge cash patients significantly less than those with insurance.

Our alternative, Obama Care approved health coverage.

| About 7 years ago, Shane and I read a book called "The Irresistible Revolution" by Shane Claiborne and it both wrecked and improved our lives. The book is basically the story of Shane Claiborne's journey from living in the suburbs in Tennessee as a typical Christian American, to purposefully living in the projects of downtown Philly. There is one chapter in the book where Shane talked about his health coverage through a Christian organization called Christian Healthcare Ministries. Christian Healthcare Ministries, or CHM, was formed as a way for Christians to help share the burden of each other's medical fees. CHM consists of thousands of members today from all over the US. They offer 3 different plans (Gold, Silver, and Bronze) and members select a plan based on what they can afford. Whenever a member goes to the hospital, CHM pays the medical bill in full. |

The only "downside" to CHM is doctor's visits (annual check ups) not related to an illness or pregnancy are not covered. I don't consider that a downside at all though; Since I am a cash patient for my annual check ups, I only pay $100 for my annual visits. BCBS wants me to pay $4800 a year for my health coverage, plus at least a $20 copay for doctor's visits. If you take the monthly amount of $45 I pay CHM for my plan and combine it to my annual doctor's visit fee, I'm still paying $4,180 less a year for my health coverage. Oh the things I could do with that extra $4180! For starters, there's most of my deductible for an unforeseeable emergency visit to the hospital!

Bring on 2017!

RSS Feed

RSS Feed